Note to Instructor: This exam item is similar to Exercise 3 except that the exchange rates have been changed and the temporal method is used instead of the current rate method.

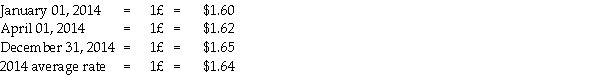

The Polka Corporation, a U.S. corporation, formed a British subsidiary on January 1, 2014 by investing 550,000 British pounds (£) in exchange for all of the subsidiary's no-par common stock. The British subsidiary, Stripe Corporation, purchased real property on April 1, 2014 at a cost of £500,000, with £100,000 allocated to land and £400,000 allocated to the building. The building is depreciated over a 40-year estimated useful life on a straight-line basis with no salvage value. The U.S. dollar is Stripe's functional currency, but it keeps its records in pounds. The British economy does not experience high rates of inflation. Exchange rates for the pound on various dates are:

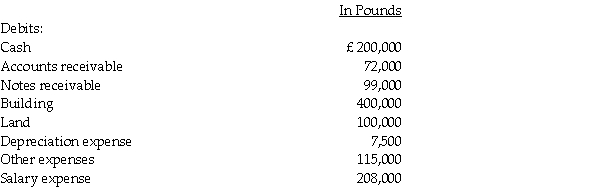

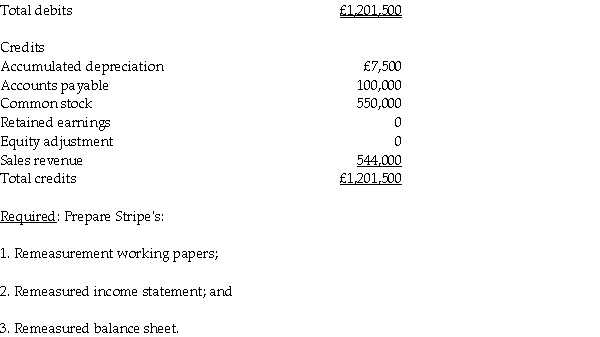

Stripe's adjusted trial balance is presented below for the year ended December 31, 2014.

Stripe's adjusted trial balance is presented below for the year ended December 31, 2014.

Definitions:

Open Coding

A qualitative research method where data, such as text or transcripts, are examined and categorized to identify themes, concepts, or patterns.

Axiological Value

The value or worth of something based on its inherent nature, often in terms of its ethical or esthetic significance.

Language

A system of communication used by a particular community or country, consisting of written, spoken, or signed words and the rules governing them.

Reality

The state of things as they actually exist, as opposed to an idealistic or notional idea of them.

Q7: GAAP requires disclosures for each reportable operating

Q13: Ending Company is in bankruptcy and is

Q19: Interest payments on loans outstanding that do

Q21: For the current football season, Tern Corporation

Q23: A corporation which makes a loan to

Q25: In reference to accounting for trusts or

Q33: Silvia Peacock has been appointed to serve

Q36: An investor uses the cost method of

Q91: The basis of an asset on which

Q124: The portion of the office in the