Use the following information to answer the question(s) below.

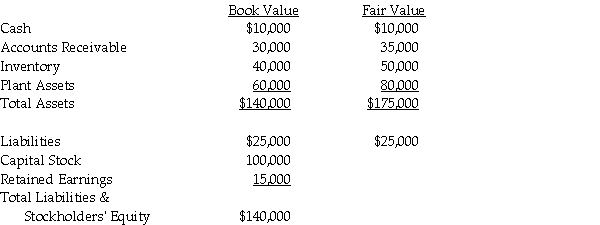

On January 1, 2014, Penelope Company acquired a 90% interest in Leah Company for $180,000 cash. On January 1, 2014, Leah Company had the following assets and liabilities:

Push-down accounting is used for the acquisition.

Push-down accounting is used for the acquisition.

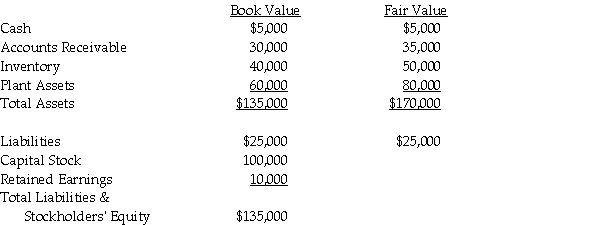

-On January 1, 2014, Jeff Company acquired a 90% interest in Margaret Company for $198,000 cash. On January 1, 2014, Margaret Company had the following assets and liabilities:

Push-down accounting is used for the acquisition.

Push-down accounting is used for the acquisition.

Required:

1. Assume both companies use the entity theory.

a. Record the journal entry on Margaret's separate books on January 1, 2014.

b. Record the journal entry on Jeff's separate books on January 1, 2014.

2. Assume both companies use the parent company theory.

a. Record the journal entry on Margaret's separate books on January 1, 2014.

b. Record the journal entry on Jeff's separate books on January 1, 2014.

Definitions:

Ascites

The accumulation of fluid in the peritoneal cavity, causing abdominal swelling, often due to liver disease or cancer.

Nonalcoholic Fatty Liver Disease (NAFLD)

A range of liver conditions affecting people who drink little to no alcohol, characterized by excessive fat stored in liver cells.

Hepatic Angiomatosis

A rare vascular disorder involving an increase in the number of blood vessels in the liver, leading to the formation of benign liver lesions.

Hepatic Sclerosis

A condition involving the hardening or scarring of the liver tissue, affecting liver function.

Q2: Assume you are preparing journal entries for

Q5: The following information is available about the

Q8: Cirtus Corporation, a U.S. corporation, placed an

Q33: Saveed Corporation purchased the net assets of

Q38: Which of the following conditions would not

Q38: On January 1, 2014, Placid Corporation acquired

Q50: Ashley and Matthew are husband and wife

Q85: Payments by a cash basis taxpayer of

Q95: Three years ago, Sharon loaned her sister

Q151: The maximum annual contribution to a Roth