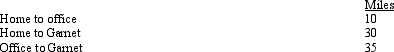

Amy works as an auditor for a large major CPA firm.During the months of September through November of each year, she is permanently assigned to the team auditing Garnet Corporation.As a result, every day she drives from her home to Garnet and returns home after work.Mileage is as follows:  For these three months, Amy's deductible mileage for each workday is:

For these three months, Amy's deductible mileage for each workday is:

Definitions:

Objectivity

The quality of being unbiased, unprejudiced, and impartial, not influenced by personal feelings or opinions in considering and presenting facts.

Suppliers

Entities that provide goods or services to another organization, often playing a critical role in the supply chain and production processes.

Holding Cost

The cost to keep or carry inventory in stock.

Thunder Bay

A city in Ontario, Canada, known for its strategic location as a transportation hub and for its historical significance in trade.

Q6: Cole Company has the following 2014 financial

Q8: Swan Finance Company, an accrual method taxpayer,

Q16: On January 1, 2014, Jeff Company acquired

Q19: The following are transactions for the city

Q25: When Betty was diagnosed as having a

Q33: Paradise Corporation owns 100% of Aldred Corporation,

Q41: Rocky has a full-time job as an

Q56: Al single, age 60, and has gross

Q122: After the automatic mileage rate has been

Q160: Sammy, age 31, is unmarried and is