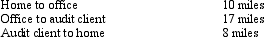

Bill is employed as an auditor by a CPA firm.On most days, he commutes by auto from his home to the office.During one month, however, he has an extensive audit assignment closer to home.For this engagement, Bill drives directly from home to the client's premises and back. Mileage information is summarized below:

If Bill spends 21 days on the audit, what is his deductible mileage?

If Bill spends 21 days on the audit, what is his deductible mileage?

Definitions:

Dimensions Of Collaboration

Refers to the various aspects and factors that contribute to effective teamwork, including communication, coordination, and goal alignment.

Governance

The framework of rules, practices, and processes by which a firm or organization is directed and controlled, focusing on the mechanisms for ensuring accountability.

Trust-Building

The process of establishing and enhancing trust among team members or within an organization through transparent communication, reliability, and integrity.

Intelligent

refers to the ability to learn, understand, and apply knowledge, reasoning, and problem-solving.

Q3: Dove Corporation pays for a trip to

Q7: On January 1, 2014, Penny Company acquired

Q18: On November 1, 2014, Ross Corporation, a

Q28: When a subsidiary has preferred stock that

Q32: Mauve Company permits employees to occasionally use

Q66: The president of Silver Corporation is assigned

Q72: Employees of the Valley Country Club are

Q103: Cathy takes five key clients to a

Q152: Aaron is a self-employed practical nurse who

Q156: Jake performs services for Maude. If Jake