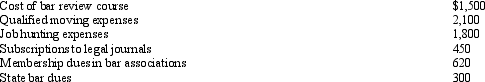

In the current year, Bo accepted employment with a Kansas City law firm after graduating from law school.Her expenses for the year are listed below:

Since Bo worked just part of the year, her salary was only $32,100.In terms of deductions from AGI, how much does Bo have?

Since Bo worked just part of the year, her salary was only $32,100.In terms of deductions from AGI, how much does Bo have?

Definitions:

CCA Class

Categories used in Canadian tax law to determine the depreciation rate for different types of business assets.

Corporate Tax Rate

The tax rate that companies are charged on their profits by the government.

Break-Even Lease Payment

The lease payment at which the cost of leasing equals the benefits received, with no net loss or gain from entering into the lease.

Cost of Debt

The effective rate that a company pays on its total debt, representing the interest expense on all outstanding debts.

Q8: Bruce, who is single, had the following

Q24: Kitty runs a brothel (illegal under state

Q27: Pashley Corporation purchased 75% of Sargent Corporation

Q30: Ivory, Inc., has taxable income of $600,000

Q32: Match the statements that relate to each

Q56: Under the right circumstances, a taxpayer's meals

Q59: In 2012, Morley, a single taxpayer, had

Q62: George purchases used seven-year class property at

Q66: If more than 40% of the value

Q144: If a vacation home is determined to