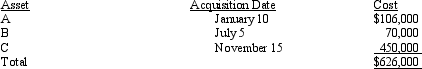

Audra acquires the following new five-year class property in 2012:

Audra elects § 179 for Asset

Audra elects § 179 for Asset

C.Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction. Audra takes additional first-year depreciation.Determine her total cost recovery deduction (including the § 179 deduction) for the year.

Definitions:

Structure

A user-defined data type in many programming languages that allows the grouping of variables of different types under a single name.

Populating

Refers to the process of putting elements or data into a data structure or database.

Actual Data Values

The specific, real data contained in variables during the execution of a program.

Q1: Why was the domestic production activities deduction

Q19: Pew Corporation (a U.S. corporation) acquired all

Q33: Polly purchased a new hotel on July

Q40: Tommy, an automobile mechanic employed by an

Q40: Paroz Corporation acquired a 70% interest in

Q41: Briefly discuss the disallowance of deductions for

Q47: Which of the following is not a

Q54: Mark is a cash basis taxpayer. He

Q68: If qualified production activities income (QPAI) cannot

Q105: The cost recovery period for new farm