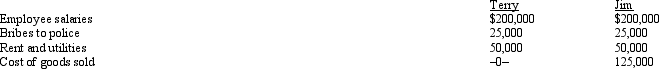

Terry and Jim are both involved in operating illegal businesses.Terry operates a gambling business and Jim operates a drug running business.Both businesses have gross revenues of $500,000.The businesses incur the following expenses.  Which of the following statements is correct?

Which of the following statements is correct?

Definitions:

Neural Impulses

Electrical signals that travel along neurons, enabling communication between different parts of the nervous system.

Hair Cells

Sensory cells located in the inner ear that are responsible for converting sound vibrations into neural signals.

Central Hearing Impairment

A type of hearing loss where the problem lies in the central nervous system, affecting the processing of sound signals to the brain.

Conduction Hearing Impairment

A form of hearing loss where sound waves are unable to efficiently travel through the external ear canal to the eardrum and ossicles of the middle ear.

Q4: Last year, Sarah (who files as single)

Q17: On January 1, 2014, Gregory Company acquired

Q19: James, a cash basis taxpayer, received the

Q39: A taxpayer just changed jobs and incurred

Q47: In January, Lance sold stock with a

Q55: When can a taxpayer not use Form

Q57: For dependents who have income, special filing

Q76: Ted and Alice were in the process

Q77: Members of a research team must include

Q130: An individual is considered an active participant