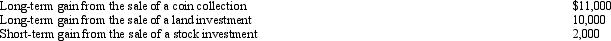

Kirby is in the 15% tax bracket and had the following capital asset transactions during 2012:  Kirby's tax consequences from these gains are as follows:

Kirby's tax consequences from these gains are as follows:

Definitions:

Daily

Occurring, done, or used every day; daily activities are part of the day-to-day routine.

Inflammatory Condition

A medical state characterized by inflammation, which is the body's response to injury, infection, or irritation.

Carvedilol

A medication used to treat high blood pressure and heart failure, functioning as a beta-blocker that also dilates blood vessels.

Q6: Samantha and her son, Brent, are cash

Q7: What losses are deductible by an individual

Q15: GreenCo, a domestic corporation, earns $25 million

Q18: Yvonne is a citizen of France and

Q20: Iris, a calendar year cash basis taxpayer,

Q41: Leo underpaid his taxes by $250,000.Portions of

Q57: A U.S.taxpayer may take a current FTC

Q74: For 2012, Stuart has a short-term capital

Q91: An "above the line" deduction refers to

Q124: Which of the following expenses associated with