Multiple Choice

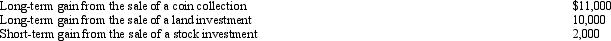

Kirby is in the 15% tax bracket and had the following capital asset transactions during 2012:  Kirby's tax consequences from these gains are as follows:

Kirby's tax consequences from these gains are as follows:

Definitions:

Related Questions

Q46: Which of the following is not a

Q56: Jake is the sole shareholder of an

Q64: Pedro is married to Consuela, who lives

Q70: Margaret owns land that appreciates at the

Q87: The exclusion of interest on educational savings

Q90: ABC Corporation mails out its annual Christmas

Q95: Velma and Josh divorced. Velma's attorney fee

Q106: Denny was neither bankrupt nor insolvent but

Q128: During the year, Jim rented his vacation

Q130: Bob is one of the income beneficiaries