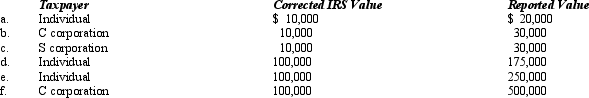

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable contribution property.In each case, assume a marginal income tax rate of 35%.

Definitions:

Sales Representative

An individual who sells products or services on behalf of a company, often directly to customers, and may also provide product information and customer service.

Reasoning

The process of forming conclusions, judgments, or inferences from facts or premises.

Writing Skills

The ability to express ideas clearly and effectively in written form, encompassing grammar, style, and structure.

Entry-Level Professional

A job position suited for individuals with minimal professional experience, typically at the start of their career.

Q6: For an activity to be considered as

Q23: An exempt entity in no circumstance is

Q30: Babs filed an amended return in 2013,

Q47: During 2012, Marvin had the following transactions:

Q53: USCo, a domestic corporation, reports worldwide taxable

Q81: Match the definition with the correct term.<br>

Q102: Regarding the rules applicable to filing of

Q107: Teal, Inc., is a private foundation which

Q139: Abbott, Inc., a domestic corporation, reports worldwide

Q141: Describe the potential outcomes to a party