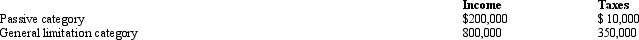

Britta, Inc., a U.S.corporation, reports foreign-source income and pays foreign taxes as follows.

Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume a 35% tax rate).What is Britta's U.S.tax liability after the FTC?

Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume a 35% tax rate).What is Britta's U.S.tax liability after the FTC?

Definitions:

Inferior Good

A type of good for which demand decreases as the income of consumers increases, in contrast to a normal good.

Equilibrium Price

The cost at which the amount of a product or service consumers want to buy matches the amount that manufacturers are willing to sell.

Equilibrium Quantity

The quantity of goods or services that is supplied is exactly equal to the quantity demanded at the equilibrium price.

Commodity X

A placeholder term for any generic, interchangeable good or service in economic analysis.

Q1: Kirby is in the 15% tax bracket

Q15: In computing the Federal taxable income of

Q34: OutCo, a controlled foreign corporation in Meena,

Q59: An S shareholder who dies during the

Q79: An exempt organization owns a building for

Q105: A profit-related activity of an exempt organization

Q105: Does the tax preparer enjoy an "attorney-client

Q107: Maria and Miguel Blanco are in the

Q142: Typically, corporate income taxes constitute about 20

Q144: Which of the following taxes that are