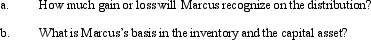

In a proportionate liquidating distribution in which the partnership is liquidated, Marcus received cash of $60,000, inventory (basis of $10,000, fair market value of $12,000), and a capital asset (basis and fair market value of $22,000).Immediately before the distribution, Marcus's basis in the partnership interest was $100,000.

Definitions:

Managerial Process

A series of actions or steps taken by managers to achieve organizational goals, including planning, organizing, leading, and controlling.

Recruitment

The process of finding and hiring the best-qualified candidate for a job opening.

Selective Perception

The process by which individuals perceive what they want to in media messages while ignoring opposing viewpoints.

Stereotypes

Overgeneralized beliefs about a particular category of people, simplifying complex human behaviors to basic assumptions.

Q7: A person who performs services for a

Q7: During the current year, Kingbird Corporation (a

Q13: PaulCo, DavidCo, and Sean form a partnership

Q38: One of the disadvantages of the partnership

Q51: Carl and Ben form Eagle Corporation.Carl transfers

Q59: A taxpayer must pay any tax deficiency

Q63: Ashley, the sole shareholder of Hawk Corporation,

Q66: What are Treasury Department Regulations?

Q103: Discuss any negative tax consequences that result

Q147: Julie and Kate form an equal partnership