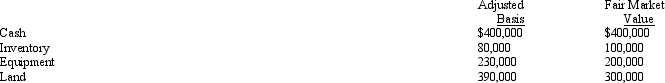

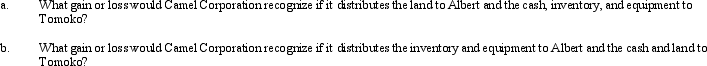

The stock in Camel Corporation is owned by Albert and Tomoko, who are unrelated.Albert owns 30% and Tomoko owns 70% of the stock in Camel Corporation. All of Camel Corporation's assets were acquired by purchase.The following assets are to be distributed in complete liquidation of Camel Corporation:

Definitions:

Grief

The deep sorrow and range of emotions experienced following the loss of someone or something significant.

Life And Death

The existential concept encompassing the events of being alive and the cessation of life.

Dying

The process leading to the cessation of all biological functions that sustain a living organism.

Voluntary Active Euthanasia

The act of deliberately ending a person's life at their request, typically to relieve them of suffering.

Q4: Compare the sale of a corporation's assets

Q38: One of the disadvantages of the partnership

Q38: Which of the following is not an

Q44: Three judges will normally hear each U.S.Tax

Q50: Scarlet Corporation (a calendar year taxpayer) has

Q53: Which of the following statements is incorrect

Q78: In structuring the capitalization of a corporation,

Q81: Ostrich, a C corporation, has a net

Q97: If an exempt organization conducts a trade

Q116: Keshia owns 200 shares in Parakeet Corporation.