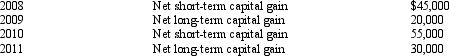

Bear Corporation has a net short-term capital gain of $35,000 and a net long-term capital loss of $200,000 during 2012.Bear Corporation has taxable income from other sources of $600,000.Prior years' transactions included the following:  Compute the amount of Bear's capital loss carryover to 2013.

Compute the amount of Bear's capital loss carryover to 2013.

Definitions:

Religious Discrimination

Unfair treatment of individuals or groups based on their religious beliefs or practices.

Right-to-Sue Letter

A document from an agency, such as the Equal Employment Opportunity Commission, giving a complainant the right to file a court lawsuit against their employer.

Private Plaintiff

An individual or private party who brings a lawsuit or legal action against another party, as opposed to actions brought by the government or public entities.

EEOC

Equal Employment Opportunity Commission, a U.S. federal agency that administers and enforces civil rights laws against workplace discrimination.

Q11: Donald owns a 60% interest in a

Q49: In order to retain the services of

Q52: In 2012, Louise incurs circulation expenses of

Q55: Use the following data to calculate Diane's

Q58: Wren Corporation (a minority shareholder in Lark

Q77: Betty's adjusted gross estate is $9 million.The

Q89: Sarah contributed fully depreciated ($0 basis) property

Q93: The AMT adjustment for research and experimental

Q95: In a proportionate liquidating distribution, Sara receives

Q116: The C corporation AMT rate can be