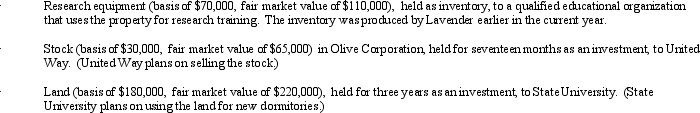

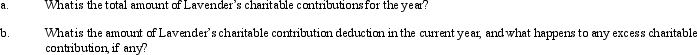

During the current year, Lavender Corporation, a C corporation in the business of manufacturing tangible research equipment, made charitable contributions to qualified organizations as follows:

Lavender Corporation's taxable income (before any charitable contribution deduction) is $2.5 million.

Lavender Corporation's taxable income (before any charitable contribution deduction) is $2.5 million.

Definitions:

Q3: The research process should begin with a

Q4: Martha has both long-term and short-term 2011

Q19: Arizona is in the jurisdiction of the

Q21: The taxpayer had incorrectly been using the

Q24: When a taxpayer transfers property subject to

Q25: The MOG Partnership reports ordinary income of

Q33: Because passive losses are not deductible in

Q45: a. Orange Corporation exchanges a warehouse located

Q46: As a general rule, the sale or

Q89: Adam transfers cash of $300,000 and land