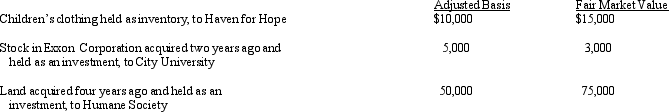

During the current year, Owl Corporation (a C corporation) , a retailer of children's apparel, made the following donations to qualified charitable organizations.  How much qualifies for the charitable contribution deduction?

How much qualifies for the charitable contribution deduction?

Definitions:

Supervision

The act of overseeing or managing the work and performance of others, often in a workplace setting.

Commuting

The act of traveling between one's home and place of work or study, typically on a regular, daily basis.

Programmer

A professional who writes, debugs, and maintains the source code of computer programs.

Q5: In 2012, Bluebird Corporation had net income

Q10: Orange Corporation owns stock in White Corporation

Q22: Meagan is a 40% general partner in

Q36: Starling Corporation has accumulated E & P

Q41: A doctor's incorporated medical practice may end

Q49: Betty, a single taxpayer with no dependents,

Q69: Which of the following statements is correct?<br>A)When

Q108: Ashlyn is subject to the AMT in

Q122: Charmine, a single taxpayer with no dependents,

Q129: Thrush, Inc., is a calendar year, accrual