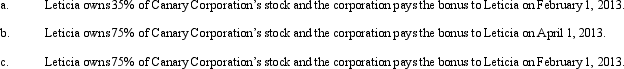

Canary Corporation, an accrual method C corporation, uses the calendar year for tax purposes. Leticia, a cash method taxpayer, is both a shareholder of Canary and the corporation's CFO. On December 31, 2012, Canary has accrued a $75,000 bonus to Leticia. Describe the tax consequences of the bonus to Canary and to Leticia under the following independent situations.

Definitions:

Accounts Receivable Turnover

Accounts receivable turnover is a financial ratio that measures how many times a company can turn its accounts receivable into cash during a period.

Adjusting Entry

An accounting process used to allocate expenses and revenues between periods according to their occurrence and realization, ensuring that financial statements accurately reflect the financial position of a company at the end of an accounting period.

Financial Statements

Formal records of the financial activities and position of a business, person, or other entity, typically including the balance sheet, income statement, and cash flow statement.

Interest Note

A promissory note that includes terms for interest payments in addition to the principal amount loaned.

Q5: The treatment of corporate reorganizations is similar

Q9: An accrual basis taxpayer accepts a note

Q28: Which one of the following statements about

Q30: Erin Corporation, a personal service corporation, had

Q36: The U.S.Tax Court meets most often in

Q61: As a result of a redemption, a

Q61: In order to induce Yellow Corporation to

Q72: In 2012, Beth sold equipment used in

Q81: Ostrich, a C corporation, has a net

Q164: If the buyer assumes the seller's liability