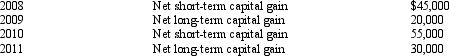

Bear Corporation has a net short-term capital gain of $35,000 and a net long-term capital loss of $200,000 during 2012.Bear Corporation has taxable income from other sources of $600,000.Prior years' transactions included the following:  Compute the amount of Bear's capital loss carryover to 2013.

Compute the amount of Bear's capital loss carryover to 2013.

Definitions:

Nonprogrammed Decision

A decision made in response to situations that are unique, relatively unstructured, and undefined, often requiring creative problem-solving.

New Market

Refers to either a completely unexplored market sector or geographic area where a product, service, or business can expand.

Certain Environment

A specific or defined setting or context in which activities or operations occur.

Factual Information

Data or details that are true and can be verified through evidence or observation, as opposed to opinions or interpretations.

Q4: Which publisher offers the Standard Federal Tax

Q7: Temporary Regulations are only published in the

Q26: Patty's factory building, which has an adjusted

Q48: What administrative release deals with a proposed

Q62: A taxpayer can obtain a jury trial

Q91: Which of the following statements is correct?<br>A)A

Q93: If a transaction qualifies under § 351,

Q97: To carry out a qualifying stock redemption,

Q111: Purple Corporation has accumulated E & P

Q152: Which of the following statements correctly reflects