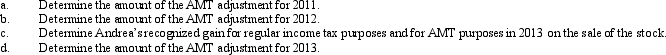

In May 2011, Egret, Inc.issues options to Andrea, a corporate officer, to purchase 200 shares of Egret stock under an ISO plan.At the date the stock options are issued, the fair market value of the stock is $900 per share and the option price is $1,200 per share.The stock becomes freely transferable in 2012.Andrea exercises the options in November 2011 when the stock is selling for $1,600 per share.She sells the stock in December 2013 for $1,800 per share.

Definitions:

Q5: Sand Corporation, a calendar year taxpayer, has

Q28: Sean, a sole proprietor, is engaged in

Q33: Because passive losses are not deductible in

Q41: During the current year, Violet, Inc., a

Q54: In determining whether § 357(c) applies, assess

Q64: Rose is a 50% partner in Wren

Q77: The earned income credit, a form of

Q94: When a taxpayer has purchased several lots

Q102: Norma formed Hyacinth Enterprises, a proprietorship, in

Q127: Which of the following statements correctly reflects