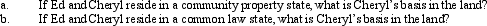

Ed and Cheryl have been married for 27 years.They own land jointly with a basis of $300,000.Ed dies in 2012, when the fair market value of the land is $500,000.Under the joint ownership arrangement, the land passed to Cheryl.

Definitions:

Dividends Payable

Refers to the amount of dividend that a company has declared to distribute to its shareholders but has not yet paid out.

Ex-dividend Basis

A stock trading status indicating that the security is sold without the right to receive the next dividend payment.

Consolidation

The process of combining the financial statements of separate subsidiaries, divisions, or entities under a single parent company to produce a unified set of financial statements.

Gain on Bargain Purchase

The excess of the fair value of the net assets acquired over the consideration paid in a business combination.

Q7: During the current year, Kingbird Corporation (a

Q29: Harold is a head of household, has

Q31: Lavender, Inc., incurs research and experimental expenditures

Q66: Evelyn's office building is destroyed by fire

Q69: List the taxpayers that are subject to

Q78: Stan, a computer lab manager, earns a

Q91: Rick spends $750,000 to build a qualified

Q94: Maria, who owns a 50% interest in

Q101: Child and dependent care expenses do not

Q104: Discuss the treatment of unused general business