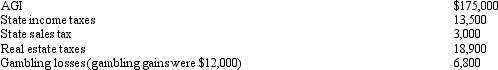

Paul, a calendar year married taxpayer, files a joint return for 2012. Information for 2012 includes the following:  Paul's allowable itemized deductions for 2012 are:

Paul's allowable itemized deductions for 2012 are:

Definitions:

Executive Workers

Individuals who hold high-ranking positions within an organization, overseeing its management and making major decisions concerning its operation.

Sexual Harassment

Unwanted or inappropriate sexual advances, requests for sexual favors, and other verbal or physical behavior of a sexual nature, which can create a hostile work environment.

Small Business

A business owned by an individual, partners, or a private group, characterized by having a smaller workforce and generating lower yearly income compared to larger corporations or standard businesses.

Lawyer

A professional who is qualified to offer advice about the law or represent someone in legal matters.

Q2: Paula owns four separate activities. She elects

Q7: What is the location of an "intentional"

Q7: Which view shows most of the port?<br>A)Lateral

Q13: In which of the following conditions is

Q23: The City of Ogden was devastated by

Q26: Phoneme-specific nasal emission typically occurs on which

Q50: Frank, a widower, had a serious stroke

Q56: In applying the percentage limitations, carryovers of

Q62: Interest paid or accrued during the tax

Q79: In October 2012, Ben and Jerry exchange