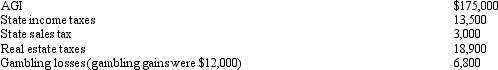

Paul, a calendar year married taxpayer, files a joint return for 2012. Information for 2012 includes the following:  Paul's allowable itemized deductions for 2012 are:

Paul's allowable itemized deductions for 2012 are:

Definitions:

Adjusting Entries

At the close of an accounting period, journal entries are made to apportion income and spending to the timeframe in which they legitimately took place.

Prepaid Insurance

Payments made in advance for insurance coverage, recorded as an asset on the balance sheet until the coverage period elapses.

Adjusting Entries

Entries in accounting made at the period's end to assign earnings and costs to their respective actual periods.

Income Statement Accounts

Accounts found on the income statement, which report a company’s financial performance over a specific period, including revenues, expenses, gains, and losses.

Q16: Tom participates for 300 hours in Activity

Q57: The purpose of the work opportunity tax

Q83: Which of the following best describes the

Q100: Linda borrowed $60,000 from her parents for

Q104: States impose either a state income tax

Q106: Paul, a calendar year married taxpayer, files

Q116: Capital recoveries include:<br>A)The cost of capital improvements.<br>B)Ordinary

Q138: Pam, a widow, makes cash gifts to

Q158: The value added tax (VAT) has had

Q171: Jesse purchases land and an office building