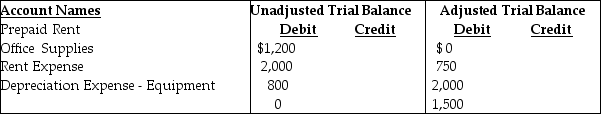

The following extract was taken from the worksheet of Miller and Miller, Inc. for the year 2019.

Miller and Miller, Inc

Worksheet

December 31, 2019  From the above information, determine the amount of the Rent Expense adjustment.

From the above information, determine the amount of the Rent Expense adjustment.

Definitions:

American Opportunity Tax Credit

An allowance for authorized costs of education paid on behalf of a qualifying individual in the first four years of college or university.

Credit Phase-Out

A gradual reduction in the amount of a tax credit as a taxpayer's income surpasses certain threshold levels, until the credit is reduced to zero.

AGI

Adjusted Gross Income (AGI) is an individual's total gross income minus specific deductions, used in calculating taxable income.

Adoption Credit

A tax credit that offsets qualified adoption expenses, making adoption financially more accessible for families.

Q21: The Accumulated Depreciation account is a permanent

Q63: The following is the adjusted trial

Q112: Jason Repair Corporation incurred $1,500 as advertising

Q119: A note receivable represents an oral promise

Q142: Provide a definition of each of

Q150: When a business uses a computerized accounting

Q173: Which of the following is a decision

Q201: At the end of the period, the

Q205: A business makes a cash payment to

Q234: Which of the following transactions will affect