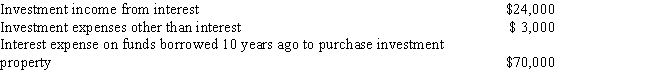

For the current tax year, David, a married taxpayer filing a joint return, reported the following: What is the maximum amount that David can deduct in the current year as investment interest expense?

Definitions:

Financial Institution

An organization that provides financial services, such as banks, insurance companies, and investment firms.

Suppliers

Entities or individuals that provide goods or services to another business, often as part of a supply chain.

Q5: Larry qualifies for a home office deduction.

Q10: Which of the following steps in the

Q20: What is withdrawal risk?<br>A) The risk that

Q37: Peter is a self-employed attorney. He gives

Q44: In the current year, Tim sells Section

Q64: William, a cash-basis sole proprietor, had the

Q65: Serissa Corporation has a Section 401(k) plan

Q81: Chorisia Corporation has a Section 401(k) plan

Q81: Which of the following is not an

Q98: Richie Rominey purchases a new $4.3 million