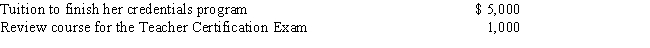

Natasha is a self-employed private language tutor. In 2016, she obtained her teaching credentials, hoping to receive a job as a seventh grade public school English teacher. She had the following education expenses for the year:

Natasha also attended a seminar in Washington, D.C., titled "The Motivated Student." Her expenses for the trip are as follows:

Determine how much of the above expenses are deductible on her Schedule C.

Determine how much of the above expenses are deductible on her Schedule C.

Definitions:

Electrocardiograph (EKG)

A medical test that measures the electrical activity of the heart to identify various heart conditions.

Electro-Oculograph (EOG)

A method of measuring eye movements by recording the electrical activity generated by the movement of the eye.

REM Rebound

The increased amount of REM sleep that occurs after REM deprivation.

NREM Sleep

Non-Rapid Eye Movement Sleep, encompassing all sleep stages except for REM, characterized by slower brain waves and decreased bodily movement.

Q6: Answer the following:<br>a.<br><br>Geoffrey filed his tax return

Q38: Calculate the following amounts:<br>a.The first year of

Q43: If an employee is transferred to a

Q47: For the current tax year, David, a

Q49: The Peach Corporation is a regular corporation

Q75: The original due date for a tax

Q76: The adjusted basis of an asset may

Q77: Amy is a calendar year taxpayer reporting

Q96: Jess has had a couple of good

Q115: During the current year, Mr. and Mrs.