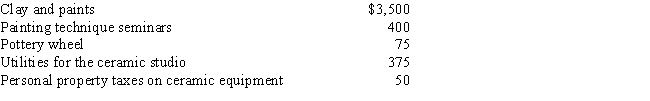

Katie operates a ceramics studio from her garage. She incurs the following expenses:

Katie's gross receipts from her business were $2,000.

a.If the studio is deemed to be a hobby, then calculate the amount of expenses Katie may deduct, and describe how she may report the income and expenses on her tax return.

b.If the studio is not a hobby, then calculate the amount of expenses Katie may deduct, and describe how she may report the income and expenses on her tax return.

Definitions:

IRS Regulations

Rules and guidelines issued by the Internal Revenue Service that interpret and enforce federal tax code.

Vendor Payment

Vendor payment refers to the process of paying suppliers or vendors for goods or services received by a business.

Journal Entries

Records of financial transactions in the accounting system, detailing the accounts and amounts affected by each transaction.

Reports Center

A dedicated area in accounting software where various types of financial reports can be generated, viewed, and analyzed.

Q11: Gary and Charlotte incurred the following expenses

Q31: Which category of tax preparers may represent

Q32: Jake developed serious health problems and had

Q51: Which of the following miscellaneous deductions is

Q53: Alan, whose wife died in 2014, filed

Q54: A taxpayer must make contributions to a

Q69: Earnings on nondeductible IRA contributions are allowed

Q72: Limited liability companies may operate in more

Q82: Under a divorce agreement executed in the

Q100: Interest earned on bonds issued by a