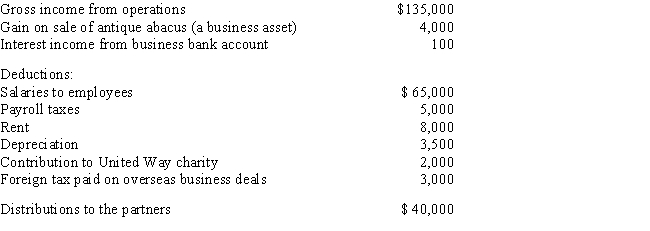

J. Bean and D. Counter formed a partnership. During the current year, the partnership had the following income and expenses:

a.Calculate the net ordinary income.

b.List all of the other items that need to be separately reported.

c.If the partnership is on a calendar year tax basis, when is the partnership tax return due?

Definitions:

African American

A term referring to Americans of African descent with roots in any of the black racial groups of Africa.

First Nations

Term primarily used in Canada to describe indigenous peoples who are not Inuit or Métis, emphasizing their status as the original inhabitants of the land.

Fatalism

The belief that all events are predetermined and therefore inevitable, rendering human effort and free will irrelevant.

Noninterference

A principle or policy of not becoming involved in the affairs of others, especially in a political or military sense.

Q8: Which of the following is false in

Q11: Which of the following statements about partnerships

Q13: Jennifer has a 25 percent interest in

Q16: Brian Temple's cumulative earnings are $102,000, and

Q31: At the beginning of the year, Joe's

Q42: Prepare the general journal entry to record

Q104: Karl's father, Vronsky, is a 60-year-old Russian

Q114: Which taxpayer would benefit the most from

Q118: Prepare the necessary general journal entry for

Q125: Prepare the necessary general journal entry for