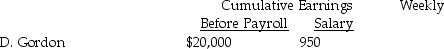

Sweetman's Recording Studio payroll records show the following information:

Assume the following:

Assume the following:

a)FICA: OASDI, 6.2% on a limit of $106,800; Medicare, 1.45%

b)Each employee contributes $40 per week for union dues

c)State income tax is 5% of gross pay

d)Federal income tax is 20% of gross pay

Prepare a general journal payroll entry.

Definitions:

Favorable Tax Treatment

Tax policies that are advantageous to businesses or individuals, often involving lower rates or specific deductions.

Working-Age Adult Americans

Individuals within the United States typically considered to be in the labor force, often defined as those aged from 18 to 64 or 65.

No Health Insurance

The condition of not having any coverage or protection against the costs of medical services.

Medical Science

A branch of science focused on the study, diagnosis, treatment, and prevention of diseases and conditions affecting humans and animals.

Q3: The Taxpayer Bill of Rights is summarized

Q16: Corporations are granted favorable tax treatment for

Q42: A deposit ticket usually separates checks deposited

Q53: Construct the bank reconciliation for Mitter Company

Q67: As a result of an IRS audit,

Q80: Amounts paid to a relative generally do

Q96: An error, on the company's books, in

Q99: Which of the following accounts would appear

Q110: Bringing account balances up to date before

Q117: Prepare a bank reconciliation from the following