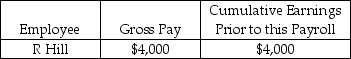

Great Lakes Tutoring had the following payroll information on February 28:  Assume:

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $106,800 and Medicare 1.45%

State Unemployment tax rate is 2% on the first $7,000

Federal Unemployment tax rate is 0.8% on the first $7,000

Using the information above, the journal entry to record the employee's tax expense would include:

Definitions:

R-Squared

A statistical measure that represents the proportion of the variance for a dependent variable that's explained by an independent variable or variables in a regression model.

F-Ratio

A statistical measure used in the analysis of variance (ANOVA) to compare the variability between groups with the variability within groups.

Diagnostic Display

High-quality, specialized monitors used in medical imaging to ensure accurate and precise viewing of digital medical images for diagnostic purposes by healthcare professionals.

Studentized Residuals

Residuals divided by their estimated standard deviation, often used in regression analysis to identify outliers.

Q4: For the following independent situations, list who

Q31: Robert and Mary file a joint tax

Q33: To close the Withdrawals account:<br>A)debit Withdrawals; credit

Q48: Prepare a general journal payroll entry for

Q54: Rob, Bill, and Steve form Big Company.

Q71: Internal control over a company's assets should

Q74: What type of account is Payroll Tax

Q96: The business failed to close any of

Q99: As the Prepaid Workers Compensation is recognized,

Q101: A nominal account is the same as