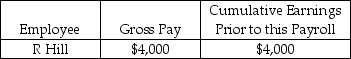

Great Lakes Tutoring had the following payroll information on February 28:  Assume:

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $106,800 and Medicare 1.45%

State Unemployment tax rate is 2% on the first $7,000

Federal Unemployment tax rate is 0.8% on the first $7,000

Using the information above, the journal entry to record the employee's tax expense would include:

Definitions:

Better Business Bureaus

Organizations that provide information about businesses, handling consumer complaints and promoting ethical business practices.

Buyer Information

The details and data about consumers that are relevant for businesses in understanding their needs, preferences, and behavior.

Moral Hazard

A situation where one party is more likely to take risks because another party bears the consequences of those risks.

Alter Behavior

The process of changing or modifying actions, habits, or conduct.

Q1: Which one of the following is not

Q9: When a bank credits your account, it

Q14: The holding period of property contributed to

Q21: ABC Company owns 40 percent of JMT

Q37: Prepare journal entries for the following petty

Q50: A partner's interest in a partnership is

Q75: The adjusting entry for accrued salaries is

Q100: Avery is a single 26 year old

Q102: The child and dependent care provisions:<br>A)Apply only

Q113: Payment for merchandise sold on credit for