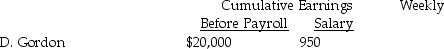

Sweetman's Recording Studio payroll records show the following information:

Assume the following:

Assume the following:

a)FICA: OASDI, 6.2% on a limit of $106,800; Medicare, 1.45%

b)Each employee contributes $40 per week for union dues

c)State income tax is 5% of gross pay

d)Federal income tax is 20% of gross pay

Prepare a general journal payroll entry.

Definitions:

Q1: The entry to close the Fees Earned

Q14: Indicate which adjustments would require a journal

Q21: A deposit must be made when filing

Q53: Sales discounts are not taken on which

Q55: Businesses will make their payroll tax deposits

Q66: The employer's payroll taxes are deducted from

Q71: The employees collectively earn a gross wage

Q72: Closing entries:<br>A)need not be journalized since they

Q100: Prepare the necessary general journal entry for

Q105: What are the major goals of the