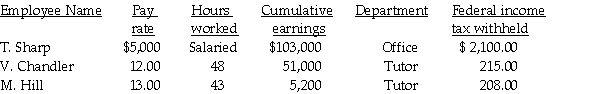

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total employer's payroll tax.

Definitions:

Posterior Cruciate Ligament

A key ligament located within the knee, vital for stabilizing the joint by preventing the tibia from moving too far backward.

Medial Collateral Ligament

A ligament located on the inner side of the knee, providing stability and limiting the joint's lateral movement.

Lateral Meniscus

A C-shaped piece of cartilage located in the knee between the femur and tibia, providing stability and reducing friction in the knee joint.

Posterior Cruciate Ligament

A ligament in the knee that connects the thigh bone (femur) to the shin bone (tibia), preventing the shin bone from moving too far backwards.

Q36: Which of the following transactions would result

Q45: Company policy for internal control should include

Q47: Phishing occurs when a bank customer receives

Q57: The use of the earned income credit

Q61: Depreciation of equipment was recorded twice this

Q76: Kathy Addington earns $72,000 per year. What

Q87: A bank service charge would be included

Q94: The May bank statement for Accounting Services

Q111: A reduction given to customers for early

Q119: Not recording the Prepaid Rent used causes:<br>A)assets