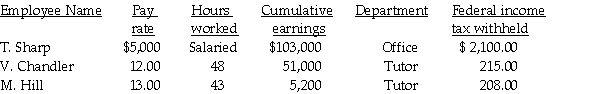

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total deductions.

Definitions:

Objective Tests

Standardized psychological tests that measure an individual's attributes or performance in a specific area by a set of questions with predefined answers, minimizing the subjective judgment of the tester.

Projective Tests

Psychological assessment tools that use ambiguous stimuli to elicit responses that reveal aspects of an individual's personality.

Aptitude Tests

Standardized tests designed to measure a person's ability or potential to acquire skills or knowledge.

Big Five Traits

A model that outlines five broad dimensions of human personality: openness, conscientiousness, extraversion, agreeableness, and neuroticism.

Q8: The American Opportunity tax credit<br>A)Is 50 percent

Q11: Received payment, within the discount period, for

Q28: Grammy's Bakery had the following information for

Q41: Which of the following transactions would most

Q53: Sales discounts are not taken on which

Q53: The payroll information for a pay period

Q61: Depreciation of equipment was recorded twice this

Q72: List and describe some of the electronic

Q95: Advantages of on-line banking include:<br>A)convenience.<br>B)transaction speed.<br>C)effectiveness.<br>D)All of

Q108: Kristin's cumulative earnings before this pay period