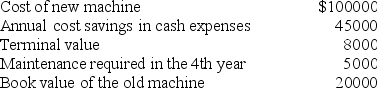

Arnold is acquiring a new machine with a life of 5 years for use on its production line. The following data relate to this purchase:  The new machine would replace an old fully-depreciated machine. The old machine can be sold for $15,000 at the time the new equipment is acquired. The income tax rate is 30%, and the discount rate is 12%. Arnold uses the straight-line method for depreciation on all machines (ignore the half-year convention) .

The new machine would replace an old fully-depreciated machine. The old machine can be sold for $15,000 at the time the new equipment is acquired. The income tax rate is 30%, and the discount rate is 12%. Arnold uses the straight-line method for depreciation on all machines (ignore the half-year convention) .

The present value of the maintenance cost in year 4 is

Definitions:

Working Relationship

Refers to a cooperative and usually task-oriented connection or interaction between individuals or groups.

Perceived Caring

An individual's sense or feeling of being cared for or nurtured by others, often associated with compassion and emotional support.

Treatment Plan

A detailed proposal for therapy targeting a patient's specific problems, including goals, intervention strategies, and expected outcomes.

Discharged Sooner

Refers to the process of allowing a patient to leave a hospital or medical facility earlier than expected or planned.

Q6: An organisation's core competencies are related to

Q12: Which type of knowledge is most costly

Q17: Uncertainty is very often a factor when

Q21: Not-for-profit organisations price products in the same

Q24: Which of these is not a benefit

Q32: Matz Ltd expects to sell 24,000 units

Q35: Benjamin Ltd invested in a 3-year project

Q47: National Bank of Victoria (NBOV) is the

Q93: Implementing a computer application to reduce non-value

Q99: For many organisations: <br>A) a relatively small