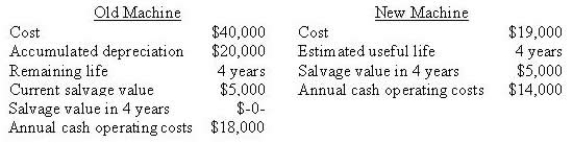

Bailey Pty Ltd is considering modernising its production by purchasing a new machine and selling an old machine. The following data have been collected on this investment:  The income tax rate is 40%, and the required rate of return is 16%. Depreciation is $5,000 per year for the old machine. The new machine would be depreciated $7,600 in 2008, $5,700 in 2009, $3,800 in 2010, and $1,900 in 2011. Assume Bailey would purchase the new machine in December 2007 and dispose of the old machine in January 2008. Bailey's 2007 depreciation tax shield for the old machine is

The income tax rate is 40%, and the required rate of return is 16%. Depreciation is $5,000 per year for the old machine. The new machine would be depreciated $7,600 in 2008, $5,700 in 2009, $3,800 in 2010, and $1,900 in 2011. Assume Bailey would purchase the new machine in December 2007 and dispose of the old machine in January 2008. Bailey's 2007 depreciation tax shield for the old machine is

Definitions:

Omega-3 Fatty Acids

Essential fatty acids found in various foods, including fish and flaxseeds, known for their anti-inflammatory properties and heart health benefits.

Oily Fish

Refers to fish species high in oil content, often rich in omega-3 fatty acids, which are considered beneficial for cardiovascular health.

Dairy Products

Dairy products are foods or beverages produced from the milk of mammals, typically cows, goats, or sheep, and include items such as cheese, yogurt, and butter.

Feces

Unabsorbed food material and cellular waste that is expelled from the digestive tract.

Q10: The master budget includes two components: an

Q11: In throughput costing the throughput of a

Q13: A practice associated with lean accounting is:<br>A)

Q21: The balanced scorecard approach to performance evaluation

Q53: In implementing a balanced scorecard, managers should

Q54: Which of the following NPV analysis methods

Q67: Which category of the ABC hierarchy has

Q73: Record the following transactions into the expanded

Q75: Product advertising for a new product is

Q101: How do managers decide which variances are