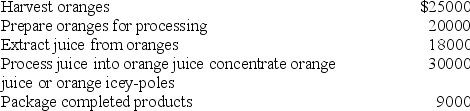

The FSOJ Company undertakes the following activities in its production operation and incurred the following costs during the first half of 2010:  Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month. During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month. During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.

Which of the preceding costs would most likely have "number of setups" as its cost driver?

Definitions:

Load Button

A user interface element that, when clicked, loads or retrieves data from a storage location or starts a process.

FV Function

A type of financial function that calculates the future value of an investment based on a constant interest rate.

Interest

A fee paid for the use of borrowed money, typically expressed as an annual percentage of the loan amount.

Power Pivot

An Excel feature that allows users to perform powerful data analysis and create sophisticated data models, integrating data from various sources.

Q2: Data extracted from the accounting information system

Q2: Kelly Ltd uses a weighted-average process costing

Q3: Organisations interested in using activity-based management must

Q21: Liva Company wants to develop a cost

Q30: Rewarding employees in one production department for

Q38: In job costing the allocation of overhead

Q57: In a production budget, beginning inventory plus

Q65: The contribution margin per unit is calculated

Q74: Managers can use activity-based management to control

Q86: General Ltd. budgeted fixed overhead costs of