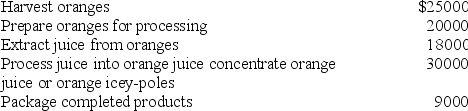

The FSOJ Company undertakes the following activities in its production operation and incurred the following costs during the first half of 2010:  Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.

During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.If juice extraction costs are allocated to product lines based on relative sales values, that is, each product line's portion of total sales, the amount allocated to icey-poles will be

Definitions:

Legal Capital

The minimum amount of capital that a company must maintain as required by law, often to protect creditors.

Assigned

Attributed or designated to a particular task, resource, or responsibility within an organization or process.

Cash Dividend

A payment made by a company out of its earnings to its shareholders, typically in the form of cash.

Retained Earnings

Retained earnings are the portion of a company's net income that is kept within the company instead of being paid out to shareholders as dividends, used for reinvestment.

Q2: Kelly Ltd uses a weighted-average process costing

Q17: Activity-based costing, compared to traditional costing, decreases

Q19: If all other factors remain unchanged, a

Q22: To overcome possible problems with budgets that

Q40: Hendrix Ltd employs a process costing system.

Q48: Which of the following is a possible

Q51: The costs of designing and implementing an

Q53: Shipp Ltd. budgets the following costs for

Q69: Which of the following types of capacity

Q82: Bailey Pty Ltd is considering modernising its