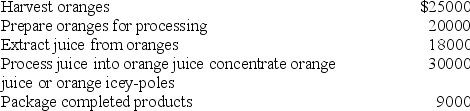

The FSOJ Company undertakes the following activities in its production operation and incurred the following costs during the first half of 2010:  Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month. During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month. During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.

Which of the preceding costs would most likely have "number of setups" as its cost driver?

Definitions:

Generally Accepted Accounting Principles

A collection of commonly-followed accounting rules and standards for financial reporting.

Financial Accountants

Professionals specializing in managing and reporting a company's financial transactions, ensuring compliance with accounting principles and regulations.

Stockholders' Approval

Stockholders' approval is the consent given by shareholders for certain business decisions or corporate actions, typically during a vote at a shareholders' meeting.

Financial Accounting Standards Board

An independent organization responsible for establishing accounting and financial reporting standards for companies and non-profit organizations in the United States.

Q1: PFA Ltd uses a throughput costing system

Q3: Miramar Ltd uses a weighted-average process costing

Q16: The Beyond Budgeting philosophy does not require

Q19: Which of the following is not required

Q19: Le Pavilion is a historic hotel just

Q27: Estimates of future costs can be used

Q27: Hendrix Ltd employs a process costing system.

Q74: The high-low method is a specific application

Q82: An allocation base is<br>A) Normally related to

Q91: Equivalent units measure the resources used in