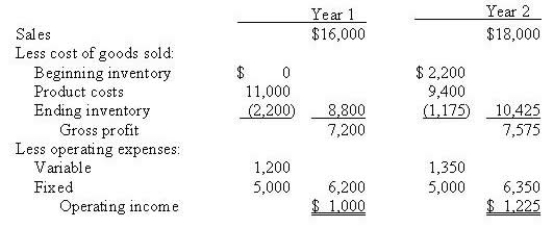

Bella Ltd has operated for 2 years. During that time it produced 1,000 units in year 1 and 800 in year 2, while sales were 800 units in year 1 and 900 in year 2. Variable production costs were $8 per unit during both years. The company uses last-in, first-out (LIFO) for inventory costing. The absorption costing income statements for these 2 years were:  Cost of goods sold for year 1 using variable costing would be

Cost of goods sold for year 1 using variable costing would be

Definitions:

Economic Rent

Economic rent is the excess payment made to or received by a factor of production over and above what would have been needed to bring that factor into production.

Competitive Factor Market

A market for inputs where firms purchase resources necessary for production, characterized by many sellers and buyers.

Inframarginal Workers

Employees whose productivity and wage are above the minimum required for employment, but are not the highest performers.

Marginal Expenditure Curve

A graph that shows the additional cost of purchasing one more unit of a good or service.

Q1: Product quality is seldom a factor in

Q9: Financial statements usually distinguish between fixed and

Q15: Gold Company has the following balances at

Q20: A formalised financial plan for organisational operations

Q24: One way to deal with constrained resources

Q55: Uncertainties affect<br>A) Special order decisions and outsourcing

Q72: Theoretical capacity is a supply-based capacity measurement.

Q86: General Ltd. budgeted fixed overhead costs of

Q99: Because absorption costing capitalises fixed manufacturing overhead

Q100: Standard costing allows management to <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3591/.jpg"