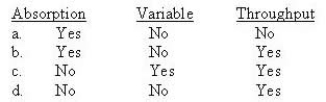

Which costing method(s) conform with GAAP?

Definitions:

FUTA Tax

Federal Unemployment Tax Act tax, which is a payroll tax paid by employers to fund the government's unemployment insurance program.

SUTA Tax

The State Unemployment Tax Act tax, a payroll tax that employers pay to fund the state's unemployment insurance.

Payroll Data

Information related to employees' salaries, wages, bonuses, and deductions, essential for processing payroll and ensuring accurate financial records.

Gross Earnings

The total income earned by an individual or business before any deductions like taxes or expenses are subtracted.

Q2: Activity-based management and activity-based costing are two

Q14: For companies with multiple products, the sales

Q27: Hendrix Ltd employs a process costing system.

Q36: Errors in the accounting records related to

Q38: When standard costs are used as benchmarks,

Q43: Absorption costing will produce a larger operating

Q49: Burkett Company uses a standard cost system.

Q65: The first step in estimating a cost

Q88: On 1<sup>st</sup> September, Kelita Ltd had 20,000

Q108: The general rule is to discontinue a