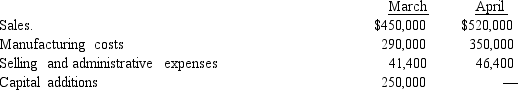

The treasurer of Calico Dreams Company has accumulated the following budget information for the first two months of the coming fiscal year:

The company expects to sell about 35% of its merchandise for cash.Of sales on account, 80% are collected in full in the month of the sale, and the remainder in the month following the sale.One-fourth of the manufacturing costs are paid in the month in which they are incurred, and the other three-fourths in the following month.Depreciation, insurance, and property taxes represent $6,400 of the monthly selling and administrative expenses.Insurance is paid in February, and property taxes are paid yearly in September.A $40,000 installment on income taxes is to be paid in April.Of the remainder of the selling and administrative expenses, one-half are to be paid in the month in which they are incurred and the balance in the following month.Capital additions of $250,000 are paid in March.

The company expects to sell about 35% of its merchandise for cash.Of sales on account, 80% are collected in full in the month of the sale, and the remainder in the month following the sale.One-fourth of the manufacturing costs are paid in the month in which they are incurred, and the other three-fourths in the following month.Depreciation, insurance, and property taxes represent $6,400 of the monthly selling and administrative expenses.Insurance is paid in February, and property taxes are paid yearly in September.A $40,000 installment on income taxes is to be paid in April.Of the remainder of the selling and administrative expenses, one-half are to be paid in the month in which they are incurred and the balance in the following month.Capital additions of $250,000 are paid in March.

Current assets as of March 1 are composed of cash of $45,000 and accounts receivable of $51,000.Current liabilities as of March 1 are accounts payable of $121,500 $102,000 for materials purchases and $19,500 for operating expenses.Management desires to maintain a minimum cash balance of $25,000.

Prepare a monthly cash budget for March and April.

Definitions:

Profit Margin

A financial metric that measures the amount by which revenue from sales exceeds costs in a business, expressed as a percentage.

Net Income

The total profit (or loss) of a company after all expenses and taxes have been subtracted from total revenues.

Net Sales

The total revenue generated from sales of goods or services, minus returns, allowances, and discounts.

Price-Earnings Ratio

A measure used to value a company that shows how much investors are willing to pay per dollar of earnings.

Q88: For a period during which the quantity

Q107: begins by estimating the quantity of sales<br>A)planning<br>B)directing<br>C)controlling<br>D)budget

Q108: Purchase requisitions for Purchasing and the number

Q117: The Tom Company reports the following data:<br>

Q119: Miller and Sons' static budget for 10,000

Q126: The cash payments for Finch Company expected

Q176: Number of miles<br>A)Purchasing<br>B)Payroll accounting<br>C)Human resources<br>D)Maintenance<br>E)Information systems<br>F)Marketing<br>G)President's Office<br>H)Transportation

Q180: The following data are available from the

Q194: The cost graphs in the illustration below

Q214: What will the income of the Macro