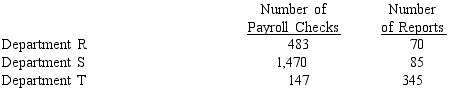

A department store apportions payroll costs on the basis of the number of payroll checks issued.Accounting costs are apportioned on the basis of the number of reports.The payroll costs for the year were $231,000, and the accounting costs for the year totaled $75,500.The departments and the number of payroll checks and accounting reports for each are as follows:

Determine the amount of a payroll cost and b accounting cost to be apportioned to each department.

Determine the amount of a payroll cost and b accounting cost to be apportioned to each department.

Definitions:

Statutory Income Tax Rate

The prescribed rate by law that a company or individual pays on income, differing by country and sometimes by income level or source.

Tax Jurisdiction

The legal authority granted to a government entity to impose taxes on individuals, businesses, or transactions within a defined geographical area.

Permanent Differences

These are differences between taxable income and accounting income that originate in one period and do not reverse subsequently.

Deferred Tax Asset

A tax relief that results from over-payment or advance payment of taxes, which can be used to reduce a company's future tax liability.

Q5: Bob's Biscuit Corporation budgeted $1,200,000 of factory

Q12: If the expected sales volume for the

Q73: The costs of services charged to a

Q90: Income from operations divided by invested assets<br>A)Controllable

Q92: Standard and actual costs for direct labor

Q98: Piano Company's costs were over budget by

Q104: Periodic comparisons between planned objectives and actual

Q116: The following are inputs and outputs to

Q148: Number of purchase requisitions<br>A)Purchasing<br>B)Payroll accounting<br>C)Human resources<br>D)Maintenance<br>E)Information systems<br>F)Marketing<br>G)President's

Q159: A company is planning to purchase a