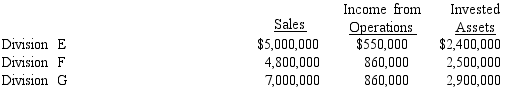

The sales, income from operations, and invested assets for each division of Grosbeak Company are as follows:

a Using the DuPont formula, determine the profit margin, investment turnover, and rate of return on investment for each division.Round profit margin percentage to two decimal places, investment turnover to four decimal places, and rate of return on investment to one decimal place.

a Using the DuPont formula, determine the profit margin, investment turnover, and rate of return on investment for each division.Round profit margin percentage to two decimal places, investment turnover to four decimal places, and rate of return on investment to one decimal place.

b Which division is the most profitable per dollar invested?

Definitions:

Net Income

The amount of profit left over after all expenses and taxes have been subtracted from total revenue.

Return on Investment

A financial metric used to evaluate the efficiency or profitability of an investment, calculated as the profit from an investment divided by the cost of the investment.

Investment Turnover

A measure of a company's efficiency in using its investments to generate sales revenue.

Profit Margin

A financial metric that measures the amount of net income generated as a percentage of revenues, indicating the efficiency of a company in turning sales into profits.

Q3: normal standard<br>A)Ideal standard<br>B)Nonfinancial performance measure<br>C)Currently attainable standard<br>D)Unfavorable

Q50: Describe at least five benefits of budgeting.

Q53: Robin Company purchased and used 500 pounds

Q57: Good Night manufactures comforters.The estimated inventories on

Q67: How much will Division C's income from

Q90: Hayden Company is considering the acquisition of

Q108: Purchase requisitions for Purchasing and the number

Q138: Future Technologies projected sales of 35,000 computers

Q141: Production and sales estimates for March for

Q145: A series of budgets for varying rates