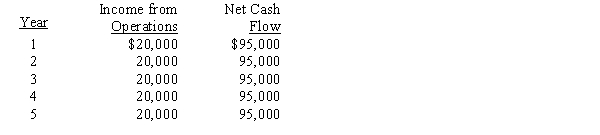

The management of River Corporation is considering the purchase of a new machine costing $380,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for five years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-The average rate of return for this investment is

Definitions:

Familywise Error

The chance of encountering one or more incorrect rejections, known as type I errors, while testing several hypotheses.

Critical Value

A critical value is a point on the scale of a statistical distribution that corresponds to a specified level of significance for the testing of a hypothesis.

Complex Comparisons

Refers to analyses involving multiple comparisons within a set of data, typically requiring adjustment of significance levels to account for the increased risk of Type I error.

Analytical Comparisons

The process of examining differences between groups or variables using statistical methods.

Q5: For Years 1-5, a proposed expenditure of

Q14: Customer service calls<br>A)Value-added<br>B)Non-value-added

Q44: Tennessee Corporation is analyzing a capital expenditure

Q46: The production department is proposing the purchase

Q84: Constraint<br>A)Demand-based concept<br>B)Competition-based concept<br>C)Product cost concept<br>D)Target costing<br>E)Production bottleneck

Q93: Determine the average rate of return for

Q114: Differential revenue is the amount of income

Q125: Discontinuing a product or segment is a

Q144: The unit selling price for the company's

Q156: The balanced scorecard measures<br>A)only financial information<br>B)only nonfinancial