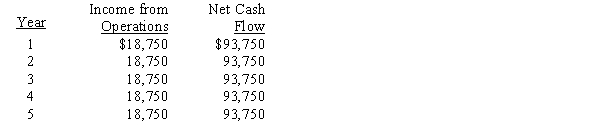

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for five years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-The net present value for this investment is

Definitions:

Elevate Casted Arm

The practice of raising an arm with a cast above the level of the heart to reduce swelling and pain.

Venous Stasis

A condition of slow blood flow in the veins, commonly in the legs, which can lead to swelling, pain, and varicose veins.

Bone Calcium

Calcium stored in the bones, providing structure and strength, and playing a critical role in bodily functions such as muscle contraction and blood clotting.

Hypercalcemia

A condition characterized by an abnormally high level of calcium in the blood, which can lead to various health issues.

Q1: Which is the best example of a

Q25: All of the following can be used

Q39: One reason that a common-sized statement is

Q93: Activity-based costing can be used to allocate

Q101: Unusual items affecting the current period's income

Q114: The average rate of return for this

Q117: The costs of initially producing an intermediate

Q122: Based on the following data for the

Q142: The production department is proposing the purchase

Q160: The present value index is computed using