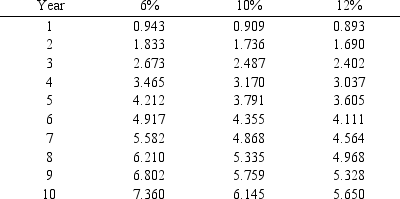

A project is estimated to cost $273,840 and provide annual net cash flows of $60,000 for 7 years.Determine the internal rate of return for this project, using the following present value of an annuity table.

Definitions:

Cash Flows

The sum of all money transfers into and from a business, significantly altering its capacity to handle liquid assets.

Annuity

A financial product delivering fixed payments to an individual, typically over a period of time or for life, often used for retirement savings.

Sinking Fund

An arrangement to guarantee that funds are available to pay off a bond’s principal at maturity.

Payments

The transfer of money or goods in exchange for products, services, or to fulfill a legal obligation.

Q4: An advantage of the current ratio is

Q28: When using the variable cost concept of

Q43: Which equation better describes target costing?<br>A)Selling price

Q53: Can be determined by initial cost divided

Q72: Determine the activity rate for procurement per

Q89: Identify four capital investment evaluation methods discussed

Q96: Using the tables above, if an investment

Q142: What is the service department charge rate

Q154: The length of time it will take

Q190: The net income for Train Corporation is<br>A)$83,180<br>B)$35,940<br>C)$48,390<br>D)$60,840