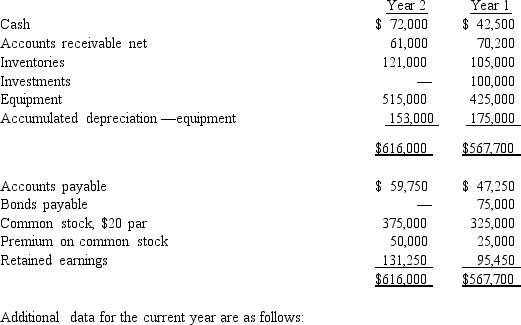

The comparative balance sheet of Barry Company for Years 1 and 2 ended December 31 appears below in condensed form:

a Net income, $75,800.

a Net income, $75,800.

b Depreciation reported on income statement, $38,000.

c Fully depreciated equipment costing $60,000 was scrapped, no salvage, and equipment was purchased for $150,000.

d Bonds payable for $75,000 were retired by payment at their face amount.

e 2,500 shares of common stock were issued at $30 for cash.

f Cash dividends declared and paid, $40,000.

g Investments of $100,000 were sold for $125,000.

Prepare a statement of cash flows using the indirect method.

Definitions:

Paid-In-Capital Accounts

Accounts representing the funds contributed by shareholders over and above the nominal value of the shares; it's an equity item on the balance sheet.

Consolidating Journal Entry

A journal entry made in the process of combining the financial statements of several departments or subsidiaries into a single set of statements.

Wholly Owned Subsidiary

A company whose entire stock is held by another company, making it completely controlled by the parent company.

Loss Associate

A situation where a company incurs a loss through its investment in an associate or joint venture.

Q3: Sales for the year were $600,000.Accounts receivable

Q4: Jam Pty Ltd has two cash generating

Q6: Nguyen Limited estimated that it would receive

Q11: Accounts receivable resulting from sales to customers

Q14: Which of the following is an appropriate

Q18: Fishy Co operates a fish farm. AASB

Q22: The adjustment required to the investment in

Q59: One inherent risk to using lean philosophy

Q95: occurs when a company abandons a segment<br>A)discontinued

Q97: The cost of merchandise sold during the