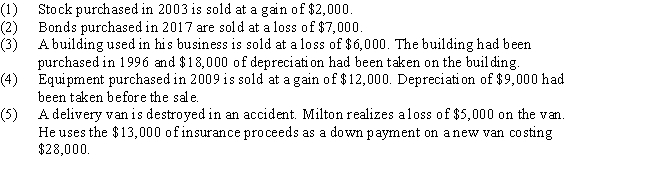

Milton has the following transactions related to his investments and his business during 2017:

a.Determine the amount and character of each gain or loss.

b.Determine the effect of the gains and losses on Milton's 2017 adjusted gross income.You must present the calculations in proper form to receive full credit.

Definitions:

Q4: Eileen is a single individual with no

Q5: Unrecaptured Section 1250 gain<br>A)Stocks,bonds,options.<br>B)Depreciable real property.<br>C)All or

Q15: Section 1231 property<br>A)Stocks,bonds,options.<br>B)Depreciable real property.<br>C)All or part

Q27: Carmen purchased a business for $150,000 by

Q33: Luisa,Lois,and Lucy operate a boutique named Mariabelle's

Q33: To obtain the rehabilitation expenditures tax credit

Q44: An airplane for a duplex apartment.<br>A)qualifies as

Q48: For the current year,Salvador's regular tax liability

Q55: Benito owns an office building he purchased

Q114: During 2017,Silverado Corporation has the following Section