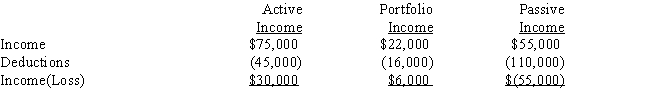

If a taxpayer has the following for the current year:

I.If the taxpayer is a regular corporation,taxable income from the three activities is a loss of $19,000.

II.If the taxpayer is an individual and the passive income is related to a rental real estate activity in which the taxpayer is an active participant,taxable income is $11,000.

Definitions:

Opportunity Cost

The bypass of potential advantages from different routes when a specific option is taken.

Agricultural Production

The process and methods used in the cultivation of plants and raising of animals for food, fiber, biofuel, medicinal plants, and other products used to sustain and enhance human life.

Labor Force

The total number of people employed and unemployed, seeking employment in an economy.

Marginal Cost

The additional expense incurred from creating one more unit of a product, highlighting how production costs change with output levels.

Q9: Sergio wants to know if he can

Q60: Straight line<br>A)The depreciation method for real estate.<br>B)A

Q61: Business casualty loss<br>A)A loss that is generally

Q71: What is the MACRS recovery period for

Q72: Gordon is the sole shareholder of Whitman

Q80: COMPREHENSIVE TAX CALCULATION PROBLEM.Girardo and Gloria are

Q98: Terry gives Brenda 1,000 shares of stock

Q100: Will and Brenda of New York City

Q105: Which of the following intangible assets is

Q146: Dorchester purchased investment realty in 2001 for