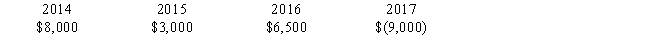

Billingsworth Corporation has the following net capital gains and losses for 2014 through 2017.Billingsworth' marginal tax rate is 34% for all years.

In 2017,Billingsworth Corporation earned net operating income of $30,000.What is/are the tax effect(s) of the $9,000 net capital loss in 2017?

I.Corporate taxable income is $21,000.

II.The net capital loss will provide income tax refunds totaling $3,060.

Definitions:

Universal Need

Fundamental requirements that are common to all humans, essential for mental and physical well-being, such as the need for safety, love, and esteem.

Testosterone Levels

The concentration of testosterone, a primary male sex hormone, present in an individual's body, which can influence various biological processes.

Personality Test

An assessment tool designed to measure and evaluate an individual's character traits, attitudes, and tendencies.

Big Five

A model outlining five major dimensions of human personality: Openness, Conscientiousness, Extraversion, Agreeableness, and Neuroticism.

Q2: Unrecaptured Section 1250 gain<br>I.applies to real property

Q5: Rand Company purchases and places into service

Q59: Morrison received a gift of income-producing property

Q67: Wilson owns a condominium in Gatlinburg,Tennessee.During the

Q71: Leon is allowed to deduct all the

Q81: Mollie is single and is an employee

Q95: During 2016,Wendy,a biologist,made a bona fide $10,000

Q101: Wayne purchases a new home during the

Q123: Watson sells equipment he used in his

Q163: Certain interest expense can be carried forward